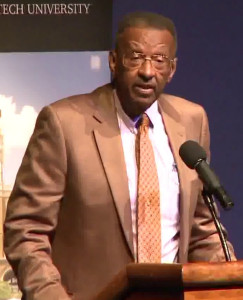

Robert J. Shiller

#51502 Most Popular

1920

1946

1967

1968

1980

1981

1982

1987

1989

1991

2000

2003

2005

2006

2007

2008

2013