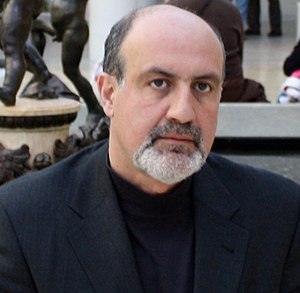

Nassim Nicholas Taleb

#11293 Most Popular

1866

1940

1960

1975

1983

1987

2000

2001

2006

2007

2008

2009

2010

2014

2016