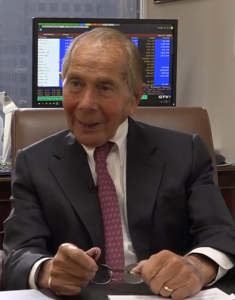

Maurice R. Greenberg

#42423 Most Popular

1925

1948

1950

1953

1960

1962

1965

1968

1987

2005

2008

2009

2010

2011

2012

2014

2016

2017

2018