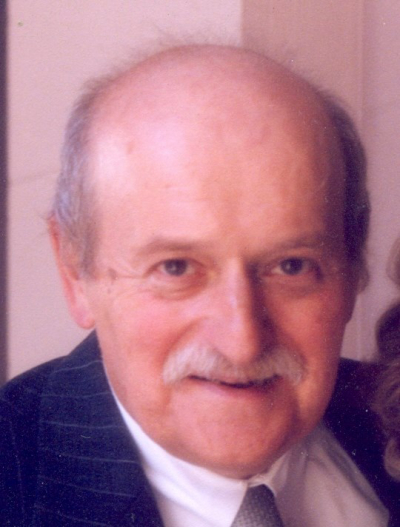

Li Ka-shing

#18715 Most Popular

1928

1940

1950

1958

1967

1971

1972

1977

1979

1980

1984

1999

2006

2018

2019