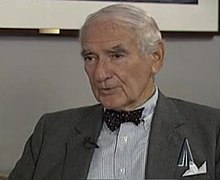

John D. Arnold

#55047 Most Popular

1974

1992

1995

1996

2001

2002

2004

2005

2007

2008

2009

2010

2012

2013

2018

2019