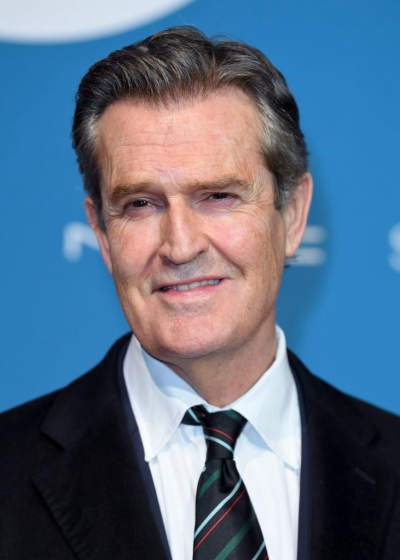

Jamie Dimon

#2610 Most Popular

1956

1979

1982

1985

1986

1990

1997

1998

2000

2004

2005

2006

2008

2009

2010

2011

2012