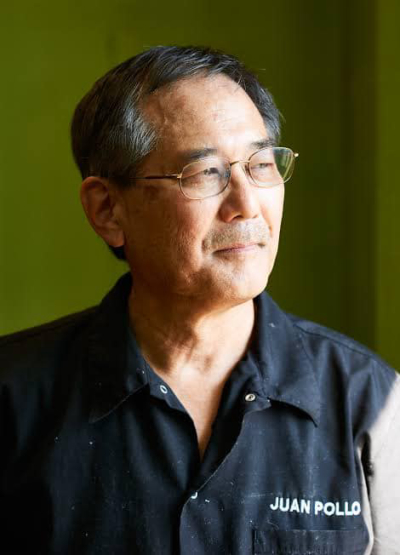

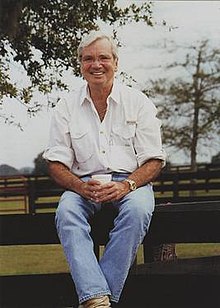

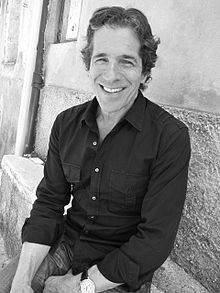

Henry Kravis

#22746 Most Popular

1944

1960

1965

1967

1972

1976

1978

1985

1987

1988

1989

1995

1997

2013

2017