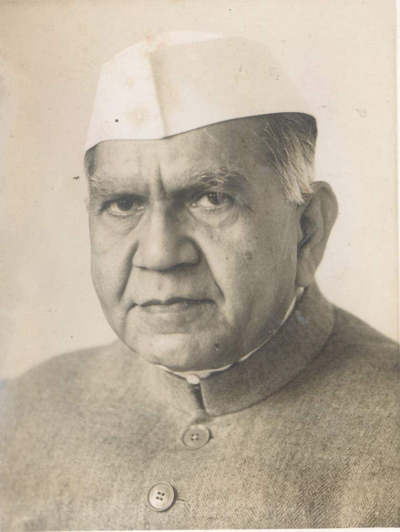

Fred Goodwin

#60838 Most Popular

1958

1983

1985

1987

1989

1991

1995

1998

2000

2001

2002

2004

2005

2006

2007

2008

2010