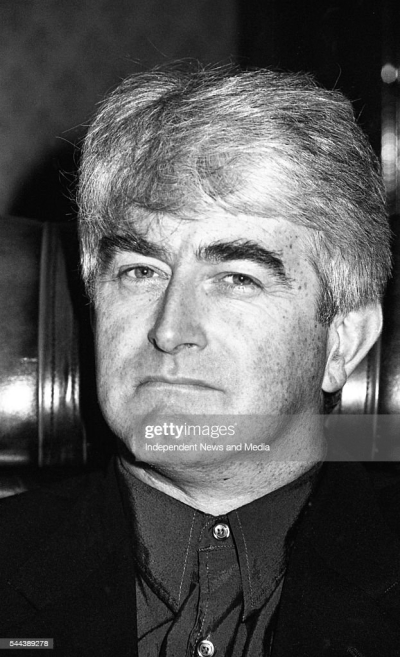

Dermot Desmond

#47576 Most Popular

1950

1968

1981

1990

1994

1995

1996

1997

2000

2001

2003

2005

2006

2013