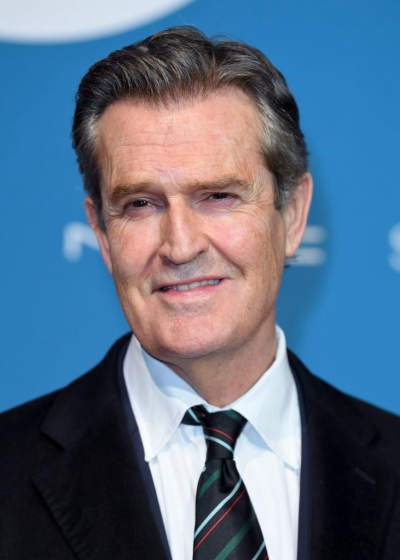

David Rubenstein

#11306 Most Popular

1949

1970

1973

1975

1987

2006

2007

2008

2016

2018

2019

2020